Best Credit Cards for Rewards and Cash Back

Compare the best credit cards offering rewards and cash back. Maximize your spending benefits.

Best Credit Cards for Rewards and Cash Back

Understanding Credit Card Rewards and Cash Back Programs

Hey there, savvy spender! Ever wondered how some people seem to get free flights, hotel stays, or even cold hard cash just by using their credit cards? It's not magic; it's the power of rewards and cash back programs. In today's financial landscape, credit cards aren't just tools for borrowing; they're sophisticated instruments designed to give you something back for your everyday spending. But with so many options out there, how do you pick the best one for you? That's exactly what we're diving into today. We'll break down the different types of rewards, compare some top cards, and help you figure out how to maximize your benefits, whether you're in the US or Southeast Asia.

First off, let's clarify the two main types of benefits: rewards and cash back. Cash back is pretty straightforward – you get a percentage of your spending back as a statement credit, direct deposit, or sometimes even a check. It's like getting a discount on everything you buy. Rewards, on the other hand, are usually points or miles that you can redeem for a variety of things: travel, merchandise, gift cards, or even experiences. While cash back offers immediate, tangible value, rewards can sometimes offer a higher redemption value, especially if you're strategic with travel. The key is understanding your spending habits and what kind of benefits align best with your lifestyle.

Top Cash Back Credit Cards for Everyday Spending

If simplicity and direct savings are your jam, cash back cards are probably your best bet. They're fantastic for everyday expenses and don't require you to jump through hoops to redeem your earnings. Let's look at some of the top contenders in the US and how they stack up.

Chase Freedom Unlimited A Versatile Cash Back Option

The Chase Freedom Unlimited is a fan favorite for a reason. It offers a solid 1.5% cash back on all purchases, which is already pretty good. But here's where it gets interesting: you also get 5% cash back on travel purchased through Chase Ultimate Rewards, 3% on dining at restaurants (including takeout and eligible delivery services), and 3% on drugstore purchases. This makes it incredibly versatile. If you're someone who eats out often, travels a bit, and needs to pick up essentials at the pharmacy, those bonus categories can really add up. Plus, there's usually a decent sign-up bonus, like earning an extra 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) – that's 3% on the first $20,000 spent! The annual fee is $0, making it a no-brainer for many. Redemption is easy: statement credit, direct deposit, or even transferring to Chase Ultimate Rewards for potentially higher value if you also have a premium Chase card like the Sapphire Preferred or Reserve.

Citi Double Cash Card Simple and Rewarding

For those who crave ultimate simplicity, the Citi Double Cash Card is a powerhouse. It offers 2% cash back on every purchase – 1% when you buy and 1% when you pay your bill. No rotating categories, no complicated redemption tiers, just a straightforward 2% back on everything. This makes it an excellent choice for your primary spending card, especially for purchases that don't fall into bonus categories on other cards. It also comes with a $0 annual fee. While it doesn't have the flashy bonus categories of some other cards, its consistent 2% back can often outperform cards with higher bonus rates if your spending isn't concentrated in specific areas. Redemption options include statement credit, direct deposit, or converting to ThankYou Points if you have other Citi cards.

Discover it Cash Back Rotating Categories for Max Savings

If you don't mind a little strategy, the Discover it Cash Back card can be incredibly rewarding. It offers 5% cash back on everyday purchases at different places each quarter, up to the quarterly maximum (usually $1,500 spent), when you activate. Past categories have included gas stations, grocery stores, restaurants, Amazon.com, and target.com. All other purchases earn 1% cash back. The real kicker? Discover matches all the cash back you've earned at the end of your first year, automatically. So, if you earn $300 in cash back, Discover gives you another $300, effectively making it 10% back on bonus categories and 2% on everything else for the first year! This card is fantastic for maximizing savings if you can align your spending with the rotating categories. It also has a $0 annual fee and is known for excellent customer service.

Best Travel Rewards Credit Cards for Adventurers

For the globetrotters and travel enthusiasts, travel rewards cards are where the real magic happens. These cards often come with higher annual fees, but the benefits – from free flights and hotel stays to airport lounge access and travel insurance – can easily outweigh the cost.

Chase Sapphire Preferred Card A Gateway to Travel

The Chase Sapphire Preferred Card is often considered the gold standard for entry-level travel rewards. It earns 2x points on travel and dining and 1x point on all other purchases. Points are worth 25% more when redeemed for travel through Chase Ultimate Rewards, meaning 10,000 points are worth $125 towards travel. But the real value comes from transferring points to airline and hotel partners at a 1:1 ratio. Think United, Southwest, Hyatt, Marriott – the possibilities are vast. The sign-up bonus is usually very generous, often 60,000 points after spending a certain amount in the first three months, which can be worth $750 towards travel. The annual fee is $95, but it's often offset by benefits like a $50 annual hotel credit and robust travel protections. This card is perfect for those who want flexibility and significant travel redemption opportunities.

American Express Gold Card Dining and Groceries Powerhouse

If your spending is heavily skewed towards dining and groceries, the American Express Gold Card is a serious contender. It earns 4x Membership Rewards points on purchases at US supermarkets (on up to $25,000 per calendar year, then 1x) and at restaurants worldwide. You also get 3x points on flights booked directly with airlines or on amextravel.com. Membership Rewards points are incredibly flexible and can be transferred to numerous airline and hotel partners, often yielding high value. The card comes with a $250 annual fee, but it's offset by up to $120 in dining credits (up to $10/month at Grubhub, Seamless, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar, and select Shake Shack locations) and up to $120 in Uber Cash ($10/month for Uber rides or Uber Eats orders in the US). If you utilize these credits, the effective annual fee is much lower, making it a great choice for foodies and frequent flyers.

Capital One Venture Rewards Credit Card Simple Travel Rewards

For those who prefer a simpler approach to travel rewards, the Capital One Venture Rewards Credit Card is a strong option. It earns an unlimited 2x miles on every purchase, every day. Miles can be redeemed for travel purchases at a fixed rate (usually 1 cent per mile) or transferred to a selection of airline partners. The sign-up bonus is typically generous, often 75,000 bonus miles after spending a certain amount in the first three months, which is worth $750 in travel. The annual fee is $95. This card is ideal for people who want straightforward travel rewards without having to worry about bonus categories or complex redemption charts. Just spend, earn miles, and redeem for any travel expense – flights, hotels, rental cars, you name it.

Premium Credit Cards for Luxury Travel and Perks

For the ultimate travel experience, premium credit cards offer a suite of luxury perks, from airport lounge access to elite status and concierge services. These cards come with higher annual fees, but the benefits can be truly exceptional for frequent travelers.

Chase Sapphire Reserve The Ultimate Travel Companion

The Chase Sapphire Reserve is a powerhouse for luxury travel. It earns 3x points on travel and dining and 1x point on all other purchases. Points are worth 50% more when redeemed for travel through Chase Ultimate Rewards, meaning 10,000 points are worth $150 towards travel. Like the Preferred, points can be transferred to airline and hotel partners at a 1:1 ratio. The annual fee is $550, but it's significantly offset by a $300 annual travel credit (automatically applied to travel purchases), Priority Pass Select airport lounge access, Global Entry/TSA PreCheck fee credit, and comprehensive travel insurance. If you travel frequently and can utilize these benefits, the Reserve can easily pay for itself and then some. It's perfect for those who value comfort, convenience, and premium travel perks.

The Platinum Card from American Express Unrivaled Benefits

The Platinum Card from American Express is synonymous with luxury travel. While its rewards rate isn't as high for everyday spending (5x points on flights booked directly with airlines or on amextravel.com, 5x points on prepaid hotels booked on amextravel.com, and 1x point on other purchases), its benefits are unparalleled. The annual fee is $695, but it comes with a staggering array of credits and perks: up to $200 airline fee credit, up to $200 Uber Cash, up to $200 hotel credit, up to $189 CLEAR Plus credit, up to $300 Equinox credit, up to $155 Walmart+ credit, and access to the Global Lounge Collection (including Centurion Lounges, Priority Pass, Delta Sky Clubs when flying Delta, and more). This card is designed for the ultra-frequent traveler who can maximize its extensive list of benefits and enjoys a premium travel experience.

Cash Back and Rewards Cards in Southeast Asia

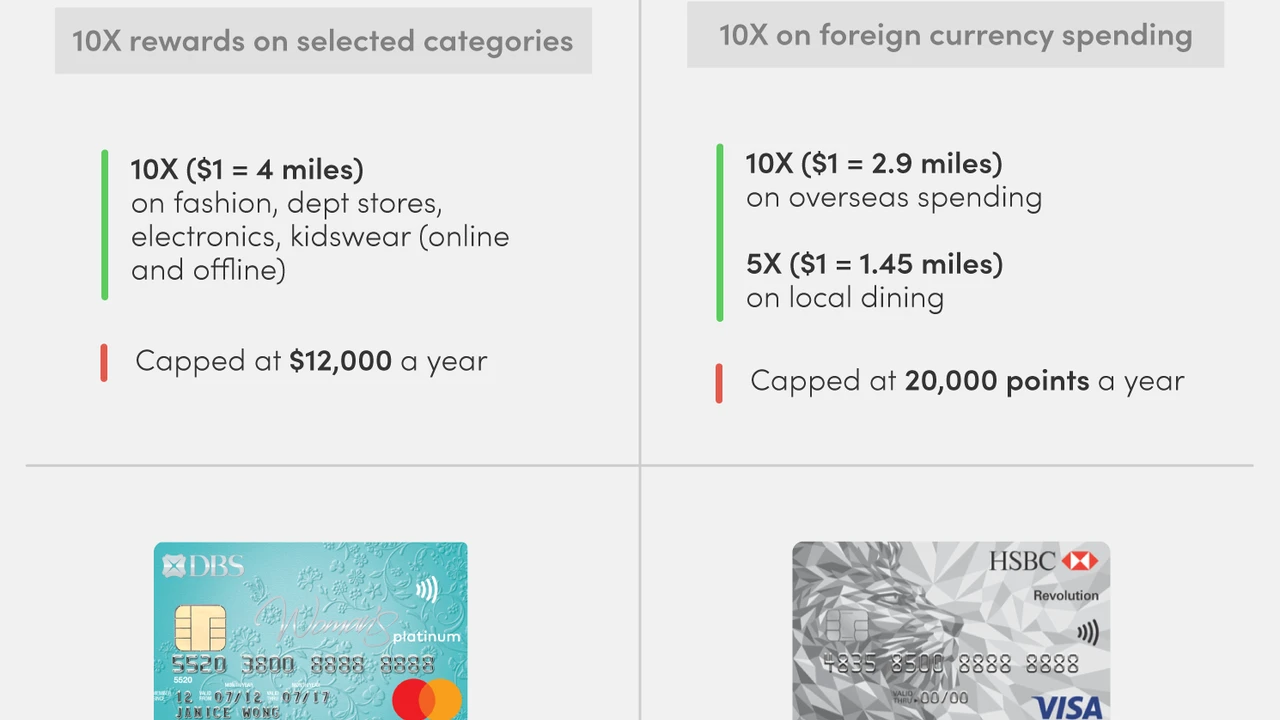

While the US market has a plethora of options, Southeast Asian markets also offer competitive cash back and rewards cards tailored to local spending habits. It's important to note that specific card offerings and terms can vary significantly by country (e.g., Singapore, Malaysia, Thailand, Indonesia, Philippines), so always check with local banks.

General Trends in Southeast Asia

In many Southeast Asian countries, cash back cards are very popular, often with bonus categories for groceries, dining, online shopping, and petrol. Travel rewards cards are also prevalent, often tied to specific airlines (like Singapore Airlines KrisFlyer, Malaysia Airlines Enrich) or hotel chains. Mobile payment integration and e-wallet top-up bonuses are also becoming increasingly common.

Example: UOB One Card Singapore

The UOB One Card in Singapore is a popular cash back option. It offers up to 10% cash back on daily spend, including Grab, Shopee, SimplyGo (bus/train rides), and more, provided you meet certain minimum spend requirements and transaction counts. This card is excellent for maximizing cash back on everyday essentials and digital services common in Singapore. It typically has an annual fee that can be waived with sufficient spending.

Example: Maybank Islamic Ikhwan Visa Platinum Card Malaysia

In Malaysia, the Maybank Islamic Ikhwan Visa Platinum Card is a good example of a card offering rewards for specific categories. It often provides 5x TreatsPoints for spending on selected categories like groceries, dining, and petrol, and 1x TreatsPoint for other retail spending. TreatsPoints can be redeemed for various items, vouchers, or even converted to airline miles. This card caters to common household spending patterns.

Example: Citi PremierMiles Card Regional Travel Focus

The Citi PremierMiles Card is available in several Southeast Asian countries (e.g., Singapore, Philippines) and is a strong contender for travel rewards. It typically offers a good earn rate on local and overseas spending, with miles that never expire. Miles can be redeemed for flights and hotels or transferred to various airline loyalty programs. It often comes with perks like complimentary airport lounge access and travel insurance, making it a solid choice for regional and international travelers.

How to Choose the Best Credit Card for You

Choosing the 'best' credit card isn't a one-size-fits-all situation. It really depends on your individual spending habits, financial goals, and what kind of rewards you value most. Here's a breakdown of factors to consider:

Analyze Your Spending Habits

Are you a big spender on groceries and dining? Do you travel frequently? Or do you prefer to keep things simple with consistent cash back on everything? Look at your bank statements from the last few months to identify your biggest spending categories. This will help you determine if a card with bonus categories or a flat-rate card is more beneficial.

Consider Your Redemption Preferences

Do you want direct cash back to offset your bills, or are you dreaming of a free vacation? Cash back is great for immediate savings, while travel points can offer higher value if redeemed strategically. Some cards offer flexible points that can be converted to either, giving you the best of both worlds.

Evaluate Annual Fees vs Benefits

Don't shy away from cards with annual fees immediately. Often, the benefits and rewards you receive can easily outweigh the cost. For example, a card with a $95 annual fee might offer a sign-up bonus worth $750 in travel, or a card with a $550 annual fee might give you $300 in travel credits and airport lounge access, effectively reducing the net cost. Do the math to see if the perks align with your lifestyle and spending.

Look for Sign-Up Bonuses

Sign-up bonuses can be incredibly lucrative and provide a significant boost to your rewards balance. Always factor these into your decision, but make sure you can comfortably meet the spending requirements without overspending.

Check for Foreign Transaction Fees

If you travel internationally or make purchases from foreign websites, a card with no foreign transaction fees is a must. These fees typically range from 2-3% of each transaction and can quickly add up.

Understand the APR and Your Payment Habits

Rewards and cash back are only beneficial if you pay your balance in full every month. If you carry a balance, the interest charges will quickly negate any rewards you earn. Always prioritize paying off your credit card debt to make these programs truly work for you.

Maximizing Your Rewards and Cash Back

Once you've chosen your card (or cards!), here are some pro tips to squeeze every last drop of value out of your rewards programs:

Use the Right Card for the Right Purchase

This is where having a few different cards can be beneficial. Use your 5% cash back card for its bonus categories, your 2% flat-rate card for everything else, and your travel card for travel and dining. This strategy, often called 'credit card churning' or 'rewards optimization,' can significantly boost your earnings.

Activate Bonus Categories

For cards like the Discover it Cash Back, remember to activate your 5% cash back categories each quarter. It's a simple step that many people forget, leaving money on the table.

Utilize Card Benefits and Credits

If your card comes with annual credits (e.g., travel credits, dining credits, Uber Cash), make sure you use them! These are designed to offset the annual fee and provide value. Set reminders if you need to.

Redeem Strategically

For points-based rewards, research the best redemption options. Sometimes, transferring points to airline or hotel partners can yield significantly more value than redeeming for cash back or merchandise. Look for transfer bonuses that can further amplify your points.

Refer Friends and Family

Many credit card companies offer referral bonuses. If you love your card, refer a friend or family member, and you could both earn extra rewards.

Monitor Your Spending

Keep an eye on your spending to ensure you're meeting minimum spend requirements for sign-up bonuses and staying within your budget. Rewards are great, but responsible spending is paramount.

Final Thoughts on Credit Card Rewards

Credit cards offering rewards and cash back are fantastic tools for making your money work harder for you. By understanding your spending, choosing the right cards, and being strategic with your redemptions, you can unlock significant savings and exciting travel opportunities. Remember, the goal isn't to spend more to earn rewards, but to earn rewards on the spending you're already doing. So, go forth, compare those cards, and start maximizing your benefits!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)