Consumer Protection Laws Southeast Asia Guide

Navigate consumer protection laws across key Southeast Asian countries. Understand your rights as a buyer.

Consumer Protection Laws Southeast Asia Guide

Understanding Consumer Rights Across Southeast Asia

Hey there, savvy shopper! Ever wondered what happens if that gadget you bought online from a seller in Singapore breaks down, or if the holiday package you booked for Thailand isn't quite what was advertised? Navigating consumer rights can be tricky enough in your home country, let alone when you're dealing with different legal systems and cultural norms across a diverse region like Southeast Asia. This guide is here to help you understand the consumer protection landscape in some of the most popular and economically significant countries in Southeast Asia: Singapore, Malaysia, Thailand, Indonesia, Vietnam, and the Philippines. We'll break down the key laws, what they mean for you, and how they compare, so you can shop, travel, and invest with greater confidence.

The digital age has blurred borders, making it easier than ever to purchase goods and services from across the globe. While this offers incredible convenience and choice, it also introduces complexities when things go wrong. Consumer protection laws are designed to level the playing field between consumers and businesses, ensuring fair trade practices, product safety, and avenues for redress. But these laws aren't uniform. What's considered a strong consumer right in one country might be less emphasized in another. Let's dive in and explore the specifics.

Singapore Consumer Protection Fair Trading Act CPFTA

Singapore, known for its robust legal framework and high standards, offers significant consumer protection primarily through the Consumer Protection (Fair Trading) Act (CPFTA). This act aims to protect consumers against unfair practices by businesses. It covers a wide range of transactions, from buying goods and services to entering into contracts.

Key Provisions of Singapore CPFTA

- Unfair Practices: The CPFTA defines and prohibits various unfair practices, such as misleading claims, false representations, and taking advantage of a consumer's inability to understand a transaction. For example, a seller claiming a product has features it doesn't possess would be an unfair practice.

- Right to Redress: If you've been a victim of an unfair practice, the CPFTA allows you to seek redress. This could include getting your money back, having the product replaced, or getting compensation for damages.

- Lemon Law: Singapore has a 'Lemon Law' embedded within the CPFTA, which is particularly useful for defective goods. If a product is found to be defective within six months of delivery, it's presumed to have been defective at the time of delivery. This shifts the burden of proof to the seller. The seller must then repair or replace the item. If these aren't possible or satisfactory, you might be entitled to a price reduction or a refund. This applies to both new and second-hand goods.

- Exclusions: It's important to note that the CPFTA generally doesn't cover transactions involving real estate, employment contracts, or certain financial services which are regulated by other specific laws.

How to Seek Redress in Singapore

For disputes in Singapore, you can approach the Consumers Association of Singapore (CASE) for mediation. If mediation fails, you can file a claim with the Small Claims Tribunals (SCT) for claims up to S$20,000 (or S$30,000 with mutual consent). The SCT provides a quick and affordable way to resolve disputes.

Malaysia Consumer Protection Act 1999 CPA

Malaysia's primary consumer protection legislation is the Consumer Protection Act 1999 (CPA). This act is comprehensive, covering various aspects of consumer transactions and aiming to promote fair and ethical business practices.

Key Provisions of Malaysia CPA

- Implied Guarantees: The CPA provides several implied guarantees for goods and services. For goods, these include guarantees as to fitness for purpose, acceptable quality, and compliance with description or sample. For services, there's a guarantee that they will be carried out with reasonable care and skill.

- Product Liability: The CPA also includes provisions for product liability, meaning manufacturers and suppliers can be held responsible for damages caused by defective products, even if there's no direct contractual relationship with the consumer.

- Unfair Contract Terms: The Act allows for the review and potential invalidation of unfair contract terms, protecting consumers from clauses that are overly burdensome or one-sided.

- Misleading and Deceptive Conduct: Similar to Singapore, the CPA prohibits misleading and deceptive conduct, false representations, and unfair practices in trade.

- Price Control and Anti-Profiteering: Malaysia also has specific regulations to control prices of essential goods and prevent excessive profiteering, especially during festive seasons or crises.

How to Seek Redress in Malaysia

In Malaysia, consumers can lodge complaints with the Ministry of Domestic Trade and Consumer Affairs (MDTCA) or directly with the Tribunal for Consumer Claims (TCC). The TCC offers an informal and inexpensive avenue for consumers to seek redress for claims up to RM50,000.

Thailand Consumer Protection Act B.E. 2522 1979

Thailand's main consumer protection law is the Consumer Protection Act B.E. 2522 (1979), with subsequent amendments. This act established the Office of the Consumer Protection Board (OCPB) to oversee and enforce consumer rights.

Key Provisions of Thailand CPA

- Rights of Consumers: The Act outlines fundamental consumer rights, including the right to receive accurate information, the right to choose, the right to safety, and the right to fair compensation for damages.

- Advertising Control: The OCPB has powers to control advertising content to prevent misleading or deceptive claims.

- Product Safety: The Act addresses product safety, allowing for the recall of unsafe products and imposing penalties on businesses that sell dangerous goods.

- Contract Terms: While not as explicit as Malaysia's CPA, Thai law also provides some protection against unfair contract terms, particularly in standard form contracts.

How to Seek Redress in Thailand

Consumers in Thailand can file complaints with the OCPB. The OCPB can mediate disputes, issue orders for businesses to comply with the law, and even initiate legal action on behalf of consumers. For smaller claims, civil courts are also an option.

Indonesia Consumer Protection Law No 8 of 1999

Indonesia's Consumer Protection Law No. 8 of 1999 is the cornerstone of consumer rights in the archipelago. It's a comprehensive law designed to protect consumers from various forms of exploitation and ensure fair business practices.

Key Provisions of Indonesia Consumer Protection Law

- Consumer Rights and Obligations: The law clearly defines consumer rights, such as the right to safety, the right to accurate information, the right to choose, and the right to compensation. It also outlines consumer obligations, like reading instructions and being careful.

- Business Responsibilities: Businesses are held responsible for providing safe products, accurate information, and fulfilling their promises. They must also compensate consumers for damages caused by their products or services.

- Prohibited Acts: The law prohibits various unfair business practices, including misleading advertising, selling expired or defective products, and imposing unfair contract terms.

- Product Liability: Manufacturers and distributors are liable for damages caused by defective products.

How to Seek Redress in Indonesia

Consumers in Indonesia can file complaints with the National Consumer Protection Agency (BPKN) or local Consumer Dispute Resolution Bodies (BPSK). These bodies can mediate, arbitrate, or adjudicate disputes. Legal action through the courts is also an option.

Vietnam Law on Protection of Consumer Rights 2010

Vietnam's Law on Protection of Consumer Rights 2010 (and its subsequent amendments) is the primary legal instrument safeguarding consumer interests. It aims to create a fair and transparent market environment.

Key Provisions of Vietnam Consumer Rights Law

- Consumer Rights: The law enumerates fundamental consumer rights, including the right to safety, the right to information, the right to choose, and the right to compensation for damages.

- Business Obligations: Businesses have obligations to provide accurate information, ensure product quality and safety, and resolve consumer complaints.

- Unfair Contract Terms: The law provides for the invalidation of unfair contract terms that are detrimental to consumers.

- Product Liability: Manufacturers and sellers are responsible for the quality and safety of their products.

How to Seek Redress in Vietnam

Consumers in Vietnam can file complaints with the Vietnam Competition and Consumer Protection Authority (VCCPA) under the Ministry of Industry and Trade, or with local consumer protection organizations. Mediation and arbitration are encouraged, and consumers can also pursue legal action through the courts.

Philippines Consumer Act of the Philippines RA 7394

The Philippines' Consumer Act of the Philippines (Republic Act No. 7394) is a comprehensive law that protects consumers against deceptive, unfair, and unconscionable sales acts and practices. It covers a wide array of consumer concerns.

Key Provisions of Philippines Consumer Act

- Protection Against Deceptive Sales Acts: The Act prohibits misleading advertising, false representations, and other deceptive practices.

- Product Quality and Safety: It ensures that products meet safety standards and are of acceptable quality. The Department of Trade and Industry (DTI) has powers to recall unsafe products.

- Price Act: The Consumer Act works in conjunction with the Price Act, which regulates prices of basic necessities and prime commodities, especially during emergencies.

- Labeling and Packaging: The Act sets standards for proper labeling and packaging to ensure consumers receive adequate information.

- Service and Repair: It also covers consumer rights related to services, including warranties for repairs.

How to Seek Redress in the Philippines

Consumers in the Philippines can file complaints with the Department of Trade and Industry (DTI) for issues related to goods and services, or with other relevant government agencies depending on the nature of the complaint (e.g., Department of Health for food and drugs). The DTI offers mediation and adjudication services.

Comparing Consumer Protection Across Southeast Asia Key Differences and Similarities

While each country has its unique legal framework, several common themes emerge in consumer protection across Southeast Asia:

- Focus on Fair Trading: All countries aim to prevent unfair and deceptive business practices, ensuring transparency and honesty in transactions.

- Product Safety and Quality: There's a universal emphasis on ensuring products are safe and meet acceptable quality standards.

- Right to Information: Consumers generally have the right to accurate and sufficient information about products and services.

- Redress Mechanisms: Each country provides avenues for consumers to seek redress, often through government agencies or specialized tribunals, aiming for accessible and affordable dispute resolution.

- Evolving Laws: Consumer protection laws are continually evolving, especially with the rise of e-commerce and digital services. Many countries are updating their laws to address online transactions, data privacy, and cross-border disputes.

However, there are also notable differences:

- Lemon Laws: Singapore has a very explicit 'Lemon Law' for defective goods, which is a strong protection. While other countries have implied guarantees of quality, the specific mechanism and burden of proof might differ.

- Scope of Coverage: The specific types of transactions covered can vary. For instance, some countries might have more explicit protections for financial services or real estate within their general consumer acts, while others rely on separate sectoral regulations.

- Enforcement Strength: The effectiveness of enforcement can vary depending on the resources and political will of the respective government agencies. Countries like Singapore tend to have very strong enforcement.

- Cultural Nuances: In some cultures, there might be a greater reluctance to complain or pursue legal action, which can impact how often consumers exercise their rights.

Practical Tips for Consumers in Southeast Asia Navigating Purchases and Disputes

Regardless of where you are in Southeast Asia, here are some universal tips to protect yourself as a consumer:

- Do Your Research: Before making a significant purchase, especially online or from an unfamiliar vendor, research the seller's reputation and read reviews.

- Read the Fine Print: Always read terms and conditions, warranty details, and return policies carefully before committing to a purchase or service.

- Keep Records: Save all receipts, invoices, contracts, and communication with the seller. These will be crucial if you need to file a complaint.

- Understand Return Policies: Be aware of the seller's return and refund policies. These can vary significantly between countries and even between different retailers.

- Check for Warranties: Understand what warranties are offered, their duration, and what they cover.

- Be Wary of Deals That Seem Too Good to Be True: Scams are prevalent everywhere. If a deal seems unbelievably good, it probably is.

- Know Where to Complain: Familiarize yourself with the relevant consumer protection agencies in the country where you are making the purchase.

- Act Promptly: If you have an issue, address it with the seller as soon as possible. Delays can sometimes weaken your case.

- Use Secure Payment Methods: When shopping online, use payment methods that offer buyer protection, such as credit cards or reputable payment gateways.

Recommended Products and Services for Consumer Protection and Awareness

While consumer protection laws provide a safety net, being proactive is always the best approach. Here are some types of products and services that can help you stay informed and protected, along with examples and considerations:

1. Digital Receipt and Warranty Management Apps

Keeping track of physical receipts and warranty cards can be a hassle, especially when you're dealing with purchases from different countries. Digital solutions can simplify this.

- Product Example: Shoeboxed or Receipt Hog (for general receipt scanning and expense tracking), or dedicated warranty management apps like Warranty Keeper.

- Usage Scenario: You buy a new smartphone in Malaysia. Instead of keeping the paper receipt, you scan it with Shoeboxed, which digitizes and categorizes it. You also input the warranty details into Warranty Keeper, setting a reminder for its expiry. If the phone develops a fault within the warranty period, all your proof of purchase and warranty information is easily accessible on your phone.

- Comparison: Shoeboxed is great for comprehensive expense tracking and receipt digitization, often used by small businesses or individuals with many purchases. Receipt Hog offers rewards for scanning receipts, making it more consumer-focused. Warranty Keeper is specialized for warranty tracking.

- Estimated Cost: Shoeboxed offers free and paid tiers (starting around $20/month for advanced features). Receipt Hog is free. Warranty Keeper might have a small one-time fee or be free with ads.

2. VPN Services for Secure Online Transactions

When making online purchases, especially across borders, securing your internet connection is paramount to protect your personal and financial data.

- Product Example: NordVPN, ExpressVPN, or Surfshark.

- Usage Scenario: You're browsing for flights or hotel deals from a public Wi-Fi network in a Southeast Asian airport. Before entering any payment details, you activate your VPN. This encrypts your internet connection, making it much harder for cybercriminals to intercept your data.

- Comparison: NordVPN is known for its strong security features and large server network. ExpressVPN is praised for its speed and ease of use. Surfshark offers unlimited simultaneous connections, making it good for families.

- Estimated Cost: Typically ranges from $3 to $12 per month, with better deals for longer subscriptions (e.g., 2-year plans often cost around $3 per month).

3. Credit Cards with Strong Buyer Protection

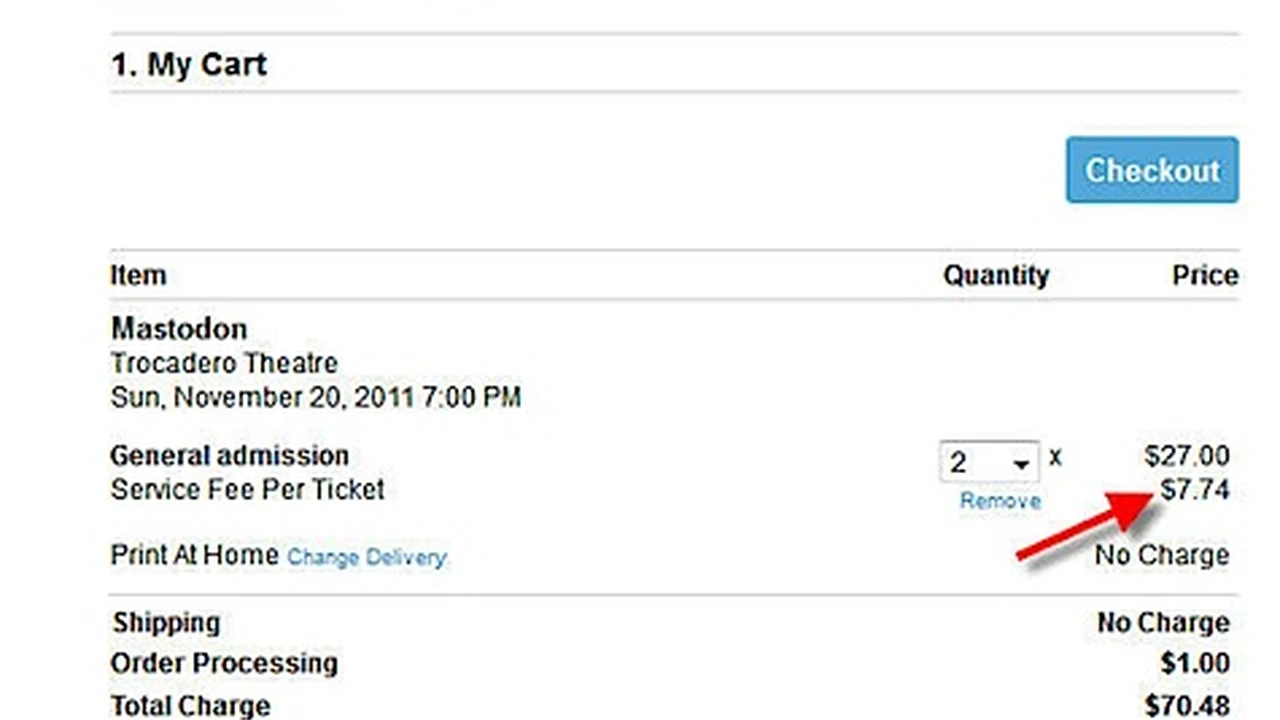

Certain credit cards offer built-in buyer protection, extended warranties, and dispute resolution services that can be invaluable when dealing with problematic purchases.

- Product Example: Visa Signature, Mastercard World Elite, or American Express cards. Specific cards like the Chase Sapphire Preferred (Visa) or Capital One Venture X (Mastercard) are popular for their travel and purchase protections.

- Usage Scenario: You bought a high-value item online from an Indonesian retailer using your Visa Signature card. The item arrives damaged, and the seller is unresponsive. You can initiate a chargeback through your credit card company, providing them with evidence of the damaged goods and the seller's lack of response. The credit card company will then investigate and potentially refund your money.

- Comparison: American Express is often lauded for its strong customer service and buyer protection policies, though its acceptance might be slightly less widespread than Visa or Mastercard in some SEA regions. Visa and Mastercard offer similar protections, but the specifics can vary greatly depending on the issuing bank and card tier.

- Estimated Cost: Many premium credit cards come with annual fees (e.g., $95 to $550+), but the benefits, including purchase protection, can outweigh the cost for frequent travelers or high-value spenders.

4. Travel Insurance with Consumer Dispute Coverage

For travelers, especially those booking tours, accommodations, or flights, travel insurance can offer a layer of protection beyond standard consumer laws.

- Product Example: Policies from providers like World Nomads, Allianz Travel Insurance, or local providers like AXA in Southeast Asia.

- Usage Scenario: You booked a tour package in Vietnam, and upon arrival, significant aspects of the tour (e.g., specific attractions, accommodation quality) were not as advertised. Your travel insurance policy might cover 'trip interruption' or 'missed connection' due to unforeseen circumstances, but some comprehensive policies also offer coverage for non-delivery of services as advertised, allowing you to claim compensation.

- Comparison: World Nomads is popular among adventurous travelers for its flexible policies. Allianz offers a wide range of plans, from basic to comprehensive. Local providers might offer more tailored coverage for specific regional risks.

- Estimated Cost: Varies widely based on trip duration, destination, coverage level, and traveler's age. A comprehensive policy for a two-week trip could range from $50 to $200+.

5. Online Review Platforms and Consumer Forums

While not a 'product' in the traditional sense, actively using and contributing to online review platforms and consumer forums is a powerful tool for collective consumer protection and awareness.

- Product Example: TripAdvisor (for travel and hospitality), Google Reviews (for local businesses), Facebook Groups (local consumer groups), or country-specific forums like Lowyat.NET (Malaysia) or Kaskus (Indonesia).

- Usage Scenario: Before booking a hotel in Bangkok, you check TripAdvisor and Google Reviews to see what other travelers say about its cleanliness, service, and adherence to advertised amenities. If you have a negative experience with a local restaurant, you can share your feedback, helping other consumers make informed choices and potentially prompting the business to improve.

- Comparison: TripAdvisor is excellent for travel-related services. Google Reviews are ubiquitous for almost any business with a physical location. Local forums often provide more in-depth discussions and specific advice relevant to that country's consumer landscape.

- Estimated Cost: Free to use and contribute.

The Future of Consumer Protection in Southeast Asia Digital Economy and Cross Border Challenges

The digital economy is rapidly transforming how consumers interact with businesses, and Southeast Asia is at the forefront of this change. With the rise of e-commerce, ride-sharing apps, food delivery services, and digital payment platforms, consumer protection laws are constantly playing catch-up.

One of the biggest challenges is cross-border transactions. If you buy something from an online seller in Vietnam while you're in Singapore, which country's laws apply? This can be a complex legal question, often depending on the terms and conditions of the sale, where the business is registered, and where the consumer resides. International cooperation between consumer protection agencies is becoming increasingly vital to address these issues effectively.

Another growing concern is data privacy. As more personal data is collected and processed by online businesses, consumers need robust protection against data breaches and misuse. While some countries like Singapore have strong data protection laws (Personal Data Protection Act - PDPA), others are still developing their frameworks.

The rise of the gig economy also presents unique challenges. Are gig workers considered employees or independent contractors? What are the consumer rights when using services provided by gig workers (e.g., ride-hailing, food delivery)? These are areas where legal frameworks are still evolving to provide clarity and protection.

Ultimately, being an informed consumer is your best defense. Understanding the general principles of consumer protection in Southeast Asia, knowing where to turn for help, and utilizing available tools and services will empower you to make smarter decisions and protect your hard-earned money in this dynamic region.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)