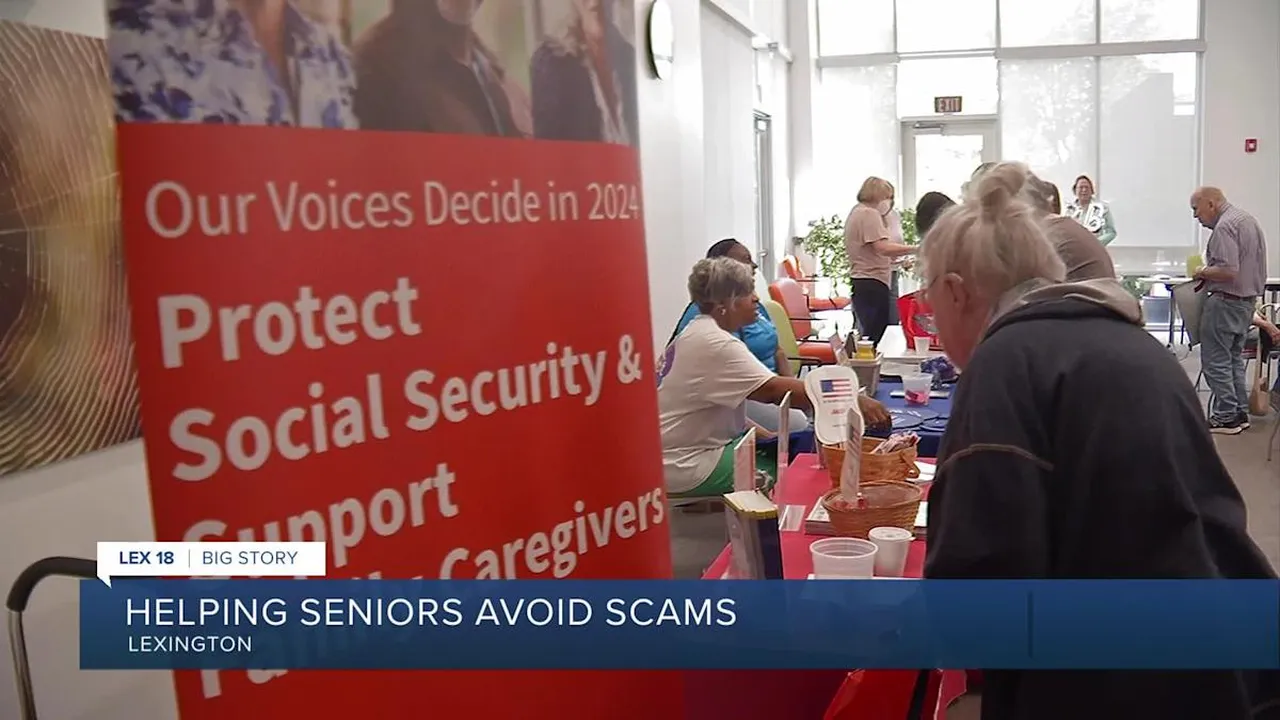

Consumer Protection for Seniors Against Scams

Discover specific consumer protection measures for seniors against common scams. Safeguard vulnerable populations.

Discover specific consumer protection measures for seniors against common scams. Safeguard vulnerable populations.

Consumer Protection for Seniors Against Scams

It's a sad truth that seniors are often targeted by scammers. Their accumulated savings, trust, and sometimes less familiarity with rapidly evolving technology make them vulnerable. But it doesn't have to be this way! This article is all about empowering seniors and their loved ones with the knowledge and tools to recognize, avoid, and report these predatory schemes. We'll dive deep into common scam types, discuss specific protection measures, and even recommend some practical tools and services that can help.

Understanding the Landscape Common Scams Targeting Seniors

Scammers are constantly evolving their tactics, but many schemes fall into recognizable categories. Knowing these can be your first line of defense.

Government Impersonation Scams Protecting Seniors from Fake Officials

Imagine getting a call from someone claiming to be from the IRS, Social Security Administration, or even a local police department. They might threaten arrest, demand immediate payment for supposed back taxes, or claim your Social Security number has been compromised. These scammers often use sophisticated spoofing techniques to make their caller ID look legitimate. They prey on fear and urgency.

- IRS Scams: The IRS will never call you demanding immediate payment via gift cards, wire transfers, or cryptocurrency. They always initiate contact via mail.

- Social Security Scams: Scammers might claim your Social Security number is suspended or that you're due a benefit increase, asking for personal information or payment. The SSA will never threaten you or ask for gift cards.

- Medicare Scams: These often involve offers of free medical equipment or services in exchange for Medicare numbers, leading to fraudulent billing.

Tech Support Scams Safeguarding Seniors from Digital Deception

You're browsing online, and suddenly a pop-up appears, claiming your computer is infected with a virus. Or you get a call from someone pretending to be from Microsoft or Apple, offering to fix a non-existent problem. They'll often ask for remote access to your computer and then charge exorbitant fees for unnecessary 'repairs' or even install malware.

- Fake Pop-ups: These often lock your browser and display alarming messages. Never call the number provided.

- Cold Calls: Legitimate tech companies rarely make unsolicited calls to fix your computer.

Grandparent Scams Protecting Elderly Family Members from Impersonation

This is a particularly cruel scam. A senior receives an urgent call or message from someone pretending to be a grandchild (or another relative) in distress. They claim to be in trouble – perhaps arrested, in an accident, or stranded in a foreign country – and need money immediately for bail, medical expenses, or travel. They'll often plead with the senior not to tell their parents, creating a sense of secrecy and urgency.

- Urgency and Secrecy: Key red flags are demands for immediate action and requests to keep it a secret.

- Payment Methods: They often ask for wire transfers, gift cards, or cryptocurrency, which are hard to trace.

Lottery and Sweepstakes Scams Protecting Seniors from False Promises

Who wouldn't want to win a huge sum of money? Scammers exploit this desire by notifying seniors they've won a lottery or sweepstakes they never entered. The catch? They need to pay 'taxes' or 'processing fees' upfront to claim their winnings. Of course, there are no winnings, and the money sent is lost.

- Upfront Fees: A legitimate lottery or sweepstakes will never ask you to pay money to receive your winnings.

- Unsolicited Notifications: If you didn't enter, you didn't win.

Romance Scams Protecting Vulnerable Seniors from Emotional Manipulation

These scams can be devastating, both financially and emotionally. Scammers create fake online profiles, often on dating sites or social media, and build emotional relationships with seniors. Over weeks or months, they develop trust and affection, then invent a crisis – a medical emergency, business failure, or travel problem – and ask for money. They often isolate their victims from family and friends.

- Quick Declarations of Love: Be wary of someone who expresses strong feelings very quickly.

- Never Meeting in Person: They'll always have an excuse not to meet.

- Asking for Money: This is the ultimate red flag.

Home Repair Scams Protecting Seniors from Shady Contractors

These scams often involve unsolicited visits from contractors offering to fix a problem they claim to have noticed (e.g., a loose roof tile, a leaky pipe). They pressure seniors into immediate repairs, often charging exorbitant prices for shoddy work or work that was never even needed. They might demand cash payment and then disappear.

- Unsolicited Offers: Be cautious of anyone who shows up at your door offering services you didn't request.

- High-Pressure Tactics: Legitimate contractors don't pressure you into immediate decisions.

Specific Protection Measures Empowering Seniors Against Fraud

Beyond knowing the scam types, there are concrete steps seniors and their families can take to build a strong defense.

Education and Awareness The Best Defense for Seniors Against Scams

Knowledge is power. Regularly discussing common scams with seniors, sharing news articles, and encouraging them to be skeptical are crucial. Many organizations offer free resources and workshops.

- Family Discussions: Create an open environment where seniors feel comfortable discussing suspicious calls or emails without fear of judgment.

- Community Resources: Local senior centers, libraries, and law enforcement often host events on scam prevention.

- Online Resources: Websites like the FTC (Federal Trade Commission), AARP, and the National Council on Aging (NCOA) provide excellent, up-to-date information.

Technology Solutions for Senior Scam Prevention Recommended Tools

Technology can be a double-edged sword, but it can also be a powerful ally in scam prevention. Here are some practical tools and services:

Call Blocking Services Protecting Seniors from Unwanted Calls

Many scams start with a phone call. Call blocking services can significantly reduce the number of unwanted and fraudulent calls.

- Nomorobo: This service (available for landlines and mobile phones) blocks robocalls and telemarketing calls. It's highly effective and has a free trial, then a small monthly fee. It works by identifying and hanging up on known robocallers.

- Truecaller: A popular app for smartphones that identifies unknown callers and blocks spam calls. It has a free version with basic features and a premium subscription for advanced blocking and caller ID.

- Carrier-Specific Blocking: Many mobile carriers (e.g., AT&T Call Protect, T-Mobile Scam Shield, Verizon Call Filter) offer free or low-cost call blocking and spam identification services. Check with your provider.

Email Spam Filters and Security Software Protecting Seniors Online

Phishing emails are a common entry point for scams. Robust email filters and antivirus software are essential.

- Gmail/Outlook Spam Filters: These built-in filters are generally very good, but it's important to teach seniors to still be cautious and report suspicious emails.

- Antivirus Software (e.g., Norton 360, Bitdefender, McAfee): These suites offer comprehensive protection, including antivirus, anti-malware, firewall, and sometimes even phishing protection. They typically cost between $40-$100 annually for a multi-device license. They scan for threats, block malicious websites, and protect against ransomware.

- Ad Blockers (e.g., uBlock Origin, AdBlock Plus): While not directly scam prevention, these can prevent malicious pop-ups and ads that sometimes lead to scam websites. They are usually free browser extensions.

Identity Theft Protection Services Safeguarding Senior Financial Information

If a scam does succeed in obtaining personal information, identity theft protection can help mitigate the damage.

- LifeLock by Norton: Offers comprehensive identity theft protection, including credit monitoring, dark web monitoring, and identity restoration services. Plans range from about $10-$30 per month. It actively monitors for suspicious activity and helps recover your identity if stolen.

- IdentityForce: Another highly-rated service providing similar features, often with a focus on rapid alerts. Plans are comparable in price to LifeLock.

- Credit Freezes: This is a free and highly effective way to prevent new accounts from being opened in a senior's name. You can place a freeze with each of the three major credit bureaus (Equifax, Experian, TransUnion). This is a proactive measure that should be considered by all seniors.

Financial Safeguards for Seniors Preventing Fraudulent Transactions

Implementing certain financial practices can add layers of protection.

- Direct Deposit: Encourage direct deposit for Social Security and pension checks to avoid mail theft.

- Regular Account Monitoring: Encourage seniors (or a trusted family member with permission) to regularly review bank and credit card statements for suspicious activity. Many banks offer transaction alerts via text or email.

- Power of Attorney (POA): For seniors who may struggle with financial management, establishing a trusted Power of Attorney can provide a legal framework for a designated individual to manage their finances and protect them from exploitation. This is a significant step and should be discussed carefully with legal counsel.

- Limiting Access to Funds: Consider setting up separate accounts for daily spending with limited funds, while keeping larger savings in accounts that require more stringent verification for withdrawals.

Communication Strategies for Families Supporting Seniors

Open and honest communication is paramount.

- Establish a Safe Word/Phrase: For grandparent scams, agree on a secret word or phrase that a grandchild would know if they were truly in trouble.

- Verify Before Acting: Teach seniors to always verify any urgent request for money or personal information, especially if it comes with a threat or a plea for secrecy. Encourage them to call a trusted family member or the organization directly using a known, legitimate phone number (not one provided by the caller).

- No Shame, No Blame: Emphasize that scammers are sophisticated and anyone can fall victim. Create an environment where seniors feel comfortable reporting suspicious activity without embarrassment.

Reporting Scams Taking Action and Seeking Help

If a senior has been targeted or fallen victim to a scam, reporting it is crucial. It helps law enforcement track down criminals and prevents others from being victimized.

Where to Report Scams Essential Resources for Seniors

- Federal Trade Commission (FTC): The FTC is the primary agency for collecting scam complaints. You can report online at reportfraud.ftc.gov or call 1-877-FTC-HELP.

- FBI Internet Crime Complaint Center (IC3): For internet-related scams, report to ic3.gov.

- Local Law Enforcement: Always report financial losses to your local police department.

- Adult Protective Services (APS): If you suspect elder abuse or financial exploitation, contact your local APS agency.

- Financial Institutions: If money was sent via bank transfer or credit card, contact the bank or credit card company immediately.

- Credit Bureaus: If personal information was compromised, place a fraud alert or credit freeze with Equifax, Experian, and TransUnion.

Recovery and Support for Senior Scam Victims Emotional and Financial Aid

Falling victim to a scam can be emotionally devastating. Support is vital.

- Emotional Support: Encourage seniors to talk about their experience with trusted family, friends, or a counselor.

- Legal Aid: In some cases, legal assistance may be available to help recover losses or navigate the aftermath.

- Victim Support Groups: Connecting with others who have experienced similar situations can be incredibly helpful.

Protecting seniors from scams requires a multi-faceted approach: education, technological safeguards, financial vigilance, and open communication. By staying informed and proactive, we can significantly reduce the vulnerability of our elderly loved ones and ensure their financial security and peace of mind.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)