Free Trials That Auto Renew What to Watch For

Understand the pitfalls of free trials that auto-renew. Tips to avoid unexpected charges after your trial ends.

Free Trials That Auto Renew What to Watch For

The Allure of Free Trials Understanding the Initial Hook

Who doesn't love a freebie? In today's digital landscape, free trials are everywhere. From streaming services to productivity software, fitness apps to online learning platforms, companies use them as a powerful marketing tool to get you hooked. The idea is simple: give consumers a taste of the product or service, hoping they'll love it so much they'll become paying subscribers. And let's be honest, it often works! We sign up for a 7-day free trial of a new movie service, a 30-day trial of a premium meditation app, or a 14-day trial of a project management tool, thinking we'll remember to cancel if it's not for us. The initial hook is strong – no upfront cost, immediate access to premium features, and the promise of a better, more convenient, or more entertaining life. It feels like a win-win situation. However, beneath this enticing surface lies a common pitfall: the auto-renewing free trial. This is where the 'free' part often ends, and unexpected charges begin. For consumers in the US and Southeast Asia, understanding how these trials work and, more importantly, how to navigate them, is crucial for protecting your wallet and avoiding subscription fatigue.

The Auto Renew Trap How Free Trials Turn Into Paid Subscriptions

The auto-renew feature is the silent assassin of your bank account. Many free trials are designed to seamlessly transition into a paid subscription once the trial period expires, often without a prominent reminder. This is a common business practice, but it can be incredibly frustrating for consumers who genuinely intended to cancel. The terms and conditions, which most of us skim or ignore, usually state this clearly. However, the sheer volume of trials we sign up for, coupled with busy lives, makes it easy to forget. One day, you might notice an unfamiliar charge on your credit card statement, only to realize it's for that fitness app you tried for a week last month. This 'set it and forget it' model benefits companies by securing recurring revenue, but it can lead to significant financial leakage for consumers. In the US, the Federal Trade Commission (FTC) has issued warnings about deceptive free trial offers, and similar concerns are rising in Southeast Asian markets where digital subscriptions are booming. The key is to be proactive rather than reactive.

Identifying Auto Renewing Trials Key Indicators and Red Flags

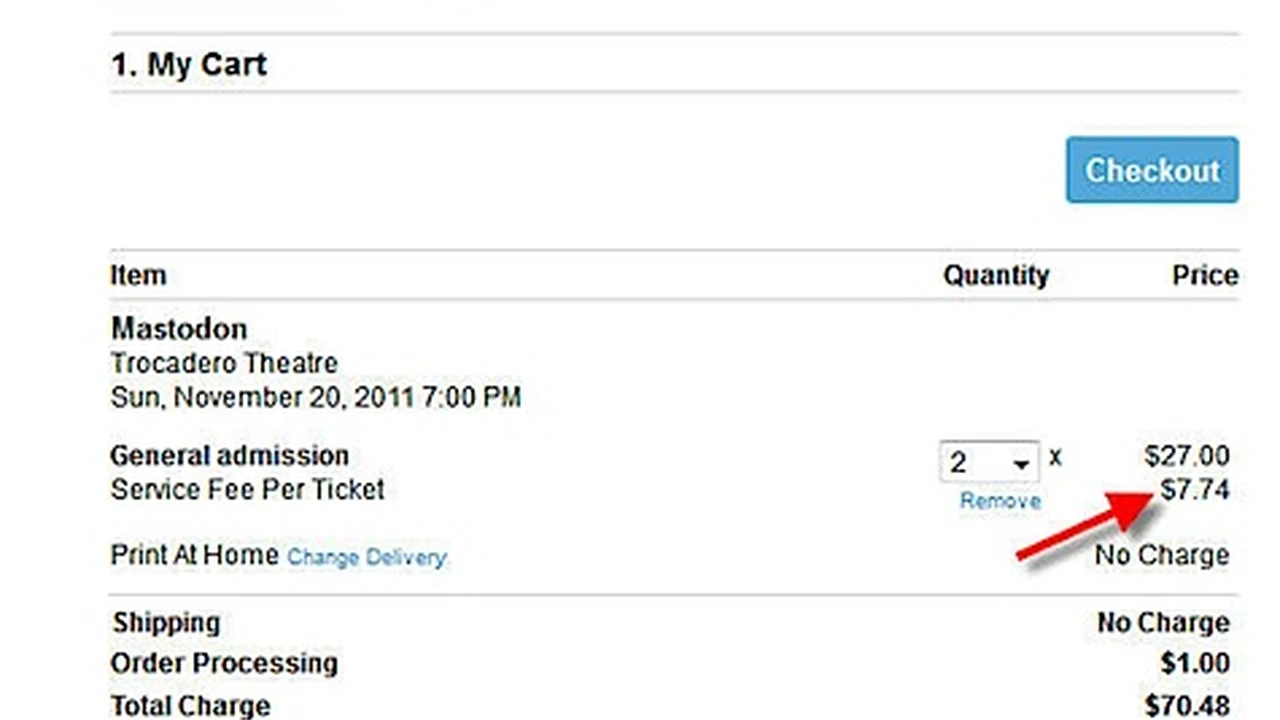

How can you tell if a free trial will auto-renew? There are several key indicators and red flags to watch out for when signing up for any 'free' service. Firstly, always look for language like 'automatically renews,' 'billed after trial,' 'recurring charges,' or 'subscription starts after trial period.' This information is usually found in the fine print, near the 'sign up' button, or within the terms and conditions. Secondly, if you're asked for your credit card details upfront for a 'free' trial, it's almost certainly going to auto-renew. Companies need this information to charge you once the trial ends. If a trial truly doesn't auto-renew, they typically won't ask for payment information until you explicitly decide to subscribe. Thirdly, check the confirmation email you receive after signing up. This email often contains details about the trial duration, the date it ends, and what happens next. Don't just delete it; give it a quick scan for these crucial details. Finally, be wary of trials that require you to download an app or software. Often, the cancellation process is buried deep within the app's settings or a website portal, making it intentionally difficult to find.

Strategies to Avoid Unwanted Charges Proactive Consumer Tips

Avoiding unwanted charges from auto-renewing free trials requires a proactive approach. Here are some effective strategies:

- Use a Calendar Reminder: As soon as you sign up for a free trial, immediately set a reminder on your phone or digital calendar for at least 24-48 hours before the trial is set to expire. This gives you ample time to evaluate the service and cancel if needed.

- Read the Fine Print: Yes, it's tedious, but take a moment to read the terms and conditions, especially the sections related to billing, cancellation, and auto-renewal. Knowledge is power.

- Use Virtual Credit Cards or Privacy Cards: Some banks and financial services offer virtual credit card numbers that can be set with spending limits or even single-use options. Services like Privacy.com (US-based) allow you to create burner cards for free trials, which can be set to expire or have a low spending limit, preventing unwanted charges. While Privacy.com is primarily for the US, some digital banks in Southeast Asia are starting to offer similar features.

- Check Your Bank Statements Regularly: Make it a habit to review your bank and credit card statements. This allows you to catch any unauthorized or forgotten charges quickly and dispute them if necessary.

- Look for 'Cancel Anytime' or 'No Credit Card Required' Trials: These are generally safer bets, as they indicate a more consumer-friendly approach to trials.

- Utilize Subscription Management Tools: Apps like Truebill (now Rocket Money), Mint, or YNAB can help you track all your subscriptions and often send reminders before trials end. While some are US-centric, global alternatives or manual tracking can still be effective.

- Cancel Immediately After Signing Up: If you're confident you only want to try the service for the free period and don't intend to continue, cancel the subscription immediately after signing up. Many services will still allow you to use the remainder of the free trial period. This removes the risk of forgetting.

Popular Services and Their Auto Renew Policies Examples and Comparisons

Let's look at some popular services and how their free trials typically work, along with tips for managing them. Keep in mind that policies can change, so always verify the current terms.

Streaming Services Navigating Entertainment Trials

Streaming services are notorious for auto-renewing trials. Almost all major players require a credit card upfront.

- Netflix: Historically offered free trials, but these are less common now. When available, they typically auto-renew. Cancellation is usually straightforward through your account settings.

- Disney+: Often offers 7-day free trials. Requires credit card. Auto-renews to a monthly or annual plan. Cancellation is via account settings.

- Amazon Prime Video: Included with Amazon Prime membership, which often has a 30-day free trial. This trial auto-renews into a paid Prime membership. You need to manage your Prime membership settings to cancel.

- HBO Max (now Max): Free trials are less common directly but might be offered through third-party providers. If you get one, expect it to auto-renew.

- Spotify Premium: Frequently offers 1-3 month free trials. Requires payment info. Auto-renews to a paid plan. Cancellation is through your Spotify account page.

- Apple Music: Often offers generous 1-3 month free trials. Requires Apple ID with payment method. Auto-renews. Manage subscriptions via your Apple ID settings on an iOS device or iTunes/Music app.

Tip for Streaming: If you're a binge-watcher, sign up for a trial, watch what you want, and then cancel immediately. You'll usually retain access for the full trial period.

Productivity and Software Tools Managing Your Digital Workspace

Many software-as-a-service (SaaS) tools offer free trials, often requiring credit card details.

- Microsoft 365: Often offers a 1-month free trial for personal or family plans. Requires a Microsoft account and payment method. Auto-renews to a paid subscription. Manage through your Microsoft account services & subscriptions page.

- Adobe Creative Cloud: Offers 7-day free trials for individual apps or the full suite. Requires an Adobe ID and payment method. Auto-renews. Cancellation is via your Adobe account management page.

- Evernote Premium: Sometimes offers free trials for their premium features. Requires account and payment. Auto-renews. Manage through Evernote's website.

- Zoom Pro: While Zoom has a robust free tier, they sometimes offer trials for Pro features. These would likely auto-renew. Manage through your Zoom account portal.

Tip for Software: For business tools, ensure your team is aware of trial end dates to avoid unexpected departmental charges. For personal use, set those calendar reminders!

Fitness and Wellness Apps Investing in Your Health (Wisely)

These apps are popular for trials, often leveraging the desire for self-improvement.

- Calm / Headspace: Often offer 7-day or 14-day free trials. Require account and payment. Auto-renew to annual subscriptions. Manage through the app's settings or your device's subscription management (Apple App Store / Google Play Store).

- Peloton App: Offers a free trial, typically 30-60 days. Requires account and payment. Auto-renews. Manage through your Peloton account.

- Nike Training Club Premium: While much of NTC is free, premium features might have trials. Check terms carefully.

Tip for Fitness Apps: Many fitness apps integrate with Apple Health or Google Fit. Check if the free features are sufficient before committing to a trial.

Online Learning Platforms Expanding Your Knowledge

Educational platforms often use trials to showcase their course libraries.

- Coursera Plus: Offers a 7-day free trial for unlimited access to many courses. Requires payment. Auto-renews to a monthly subscription. Manage through your Coursera account settings.

- Skillshare: Often offers 1-month free trials. Requires payment. Auto-renews. Manage through your Skillshare account.

- MasterClass: Less common for free trials, but sometimes offers limited-time access or special promotions. If a trial is offered, assume it auto-renews.

Tip for Learning Platforms: If you're only interested in one or two courses, check if they can be purchased individually rather than committing to a full subscription after a trial.

Specific Product Recommendations and Usage Scenarios

While the focus is on avoiding unwanted charges, some tools can help you manage trials and subscriptions effectively. Here are a few, with notes on their availability and pricing:

Subscription Management Apps Your Digital Financial Assistant

These apps act as a central hub for all your recurring payments, including those that started as free trials.

- Rocket Money (formerly Truebill):

- Usage: Connects to your bank accounts and credit cards to identify all recurring subscriptions. It can track trial end dates, send reminders, and even help you cancel subscriptions directly from the app. It also helps negotiate bills.

- Availability: Primarily US.

- Pricing: Free version with basic features. Premium subscription (variable pricing, often $3-$12/month, or annual plans) for advanced features like bill negotiation, cancellation services, and custom categories.

- Comparison: One of the most comprehensive for US users, strong in identifying hidden subscriptions and offering cancellation assistance.

- Mint (by Intuit):

- Usage: A broader personal finance app that also tracks subscriptions. It helps you budget, monitor spending, and see all your financial accounts in one place. While it identifies subscriptions, its cancellation features are less direct than Rocket Money.

- Availability: Primarily US and Canada.

- Pricing: Free.

- Comparison: Excellent for overall financial tracking and budgeting, including subscription oversight, but not specialized for direct cancellation.

- Bobby (iOS only) / SubscriptMe (iOS only):

- Usage: Simpler, manual subscription trackers. You input your subscriptions, their costs, and renewal dates, and the app reminds you. Good for those who prefer not to link bank accounts.

- Availability: Global (manual input).

- Pricing: Bobby has a free version with in-app purchases for more features. SubscriptMe is often a one-time purchase or freemium.

- Comparison: Great for privacy-conscious users or those outside regions supported by automated trackers. Requires more manual effort.

- Snoop (UK-based, expanding):

- Usage: Connects to bank accounts to find subscriptions and offers personalized insights to save money.

- Availability: Primarily UK, but worth watching for expansion.

- Pricing: Free.

- Comparison: Similar to Rocket Money but with a UK focus.

Virtual Card Services Enhancing Your Trial Security

These services provide an extra layer of protection when signing up for trials.

- Privacy.com:

- Usage: Creates virtual debit cards linked to your bank account. You can set spending limits (e.g., $1 for a trial), pause cards, or make them single-use. This prevents companies from charging you more than you intend or after a trial ends.

- Availability: US only.

- Pricing: Free for basic features. Premium tiers for more cards and features.

- Comparison: The gold standard for virtual cards in the US for subscription management.

- Revolut / Wise (formerly TransferWise):

- Usage: These digital banks offer virtual cards, often with the ability to freeze or delete them. While not as granular as Privacy.com for spending limits on individual cards, they offer a good alternative for managing online payments and trials, especially for international users.

- Availability: Global, including many Southeast Asian countries.

- Pricing: Free accounts with premium tiers for additional features.

- Comparison: Excellent for international transactions and general digital banking, with virtual card features that can be adapted for trial management.

The Psychology Behind Auto Renewals Why We Forget

It's not just about being forgetful; there's a psychological component to why auto-renewing trials are so effective for companies. Firstly, there's the 'set it and forget it' mentality. Once we've signed up, our brains move on to other tasks, assuming everything is handled. Secondly, the 'endowment effect' plays a role: once we've used a service for a few days or weeks, we start to feel a sense of ownership or attachment, making it harder to let go, even if we don't use it much. Thirdly, 'decision fatigue' means we have a limited capacity for making choices. When faced with the decision to cancel, especially if the process is cumbersome, we might defer it, leading to an unwanted charge. Finally, companies often make the cancellation process intentionally difficult, a practice known as 'dark patterns.' This could involve hiding the cancellation button, requiring phone calls instead of online cancellation, or presenting multiple 'save offer' screens. Being aware of these psychological tactics can empower you to be more vigilant.

What to Do If You've Been Charged Unexpectedly Steps for Resolution

If you find an unexpected charge from an auto-renewing free trial, don't panic. Here's what you can do:

- Contact the Merchant Directly: This should be your first step. Explain that you signed up for a free trial and intended to cancel, requesting a refund. Many companies, especially if it's your first time, will offer a refund as a gesture of goodwill to maintain customer relations.

- Check Their Refund Policy: Review the company's terms of service for their refund policy. This will give you leverage in your conversation.

- Dispute the Charge with Your Bank or Credit Card Company: If the merchant refuses to issue a refund, you can dispute the charge with your bank or credit card provider. Provide them with all relevant details, including when you signed up, when the trial ended, and your attempts to contact the merchant. This is often referred to as a 'chargeback.'

- Cancel the Subscription Immediately: Regardless of whether you get a refund, make sure to cancel the subscription to prevent future charges.

- Report Deceptive Practices: If you believe the free trial terms were intentionally misleading or the cancellation process was unduly difficult, consider reporting the company to consumer protection agencies. In the US, this would be the Federal Trade Commission (FTC) or your state's Attorney General. In Southeast Asia, look for your country's equivalent consumer protection body (e.g., DTI in the Philippines, KPDNHEP in Malaysia, OCPB in Thailand).

The Future of Free Trials Consumer Protection and Industry Trends

As consumers become more aware and regulatory bodies increase scrutiny, the landscape of free trials is slowly evolving. There's a growing push for greater transparency, clearer communication about auto-renewal, and easier cancellation processes. Some jurisdictions are even considering laws that require companies to send explicit reminders before a free trial converts to a paid subscription. For instance, California has specific laws regarding automatic renewal offers, requiring clear and conspicuous disclosure. As digital economies in Southeast Asia mature, similar consumer protection measures are likely to gain traction. The trend is moving towards more ethical trial practices, but until then, consumer vigilance remains your best defense. By understanding the mechanics of auto-renewing free trials, utilizing smart management tools, and knowing your rights, you can enjoy the benefits of trying new services without the headache of unexpected charges.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)